Yesterday afternoon the Israeli Planning Administration announced it would temporarily scrap permits for soon-to-be-constructed storage units of up to 600 kWh. The move will be in effect for the...

ICLG - Renewable Energy Laws and Regulations - Israel Chapter covers common issues in renewable energy laws and regulations – including the renewable energy market, sale of renewable energy and financial incentives, consents and permits, and storage.

Noga, Israel Independent System Operator Ltd., manages the planning and development of the electricity system and the operation of electricity production units in Israel, and is responsible for the management of electricity demand in its various aspects.

The renewable energy facilities in Israel are principally owned by the private sector and are supported by government incentives designed to ensure compliance with the national goals for renewable energies set by the government.

The renewable energy market in Israel is based almost entirely on solar energy. Over 90% of Israel’s renewable energy is sourced from photovoltaic installations, about 5% from thermo-solar installations, about 3% wind power, and just 1% from biogas, hydro-electric and other sources. Because of Israel’s geography and climate conditions, large scale renewable energy projects consist almost exclusively of photovoltaic (PV).

Despite growing interest in innovative renewable energy solutions, such as waste-to-energy technologies, the introduction of such technologies is still in the incipient stages. PV is expected to remain the leading source of renewable energy in the foreseeable future, with small-scale sources expected to supplement large scale projects.

As discussed above, although Israel has formulated an energy transition policy, the legal framework for transition is still incomplete. Energy transition is clearly a relevant factor, and Israel has set a target of 30% electricity generation from renewable sources by 2030. Investment in renewables is driven by other factors, including energy security, business opportunities, etc. While Israel seeks to phase out coal-based energy as soon as 2026, the large-scale use of natural gas for energy is expected to remain for many years to come.

Israel’s legal and regulatory framework for the generation, transmission, and distribution of renewable energy involves several key laws, regulations, and government bodies. Here is an overview of the main components:

To promote innovation and technological advancement in the renewable energy sector, there is government funding (mainly by the Governmental Innovation Authority) to support research and development (R&D) projects, collaborations with academic institutions, and incentives for private sector investment in R&D.

As of 2024, renewable energy accounts for approximately 15% of Israel’s total electricity generation capacity. While this amount is relatively small, we see in recent years a significant increase in renewable energy production and the rate of transition is expected to increase as coal is phased out (planned for 2026) and renewable energy projects are approved and constructed.

Until recently, Israel had a single electricity provider, a government-owned company (IEC) which had monopoly over the sale of power. A recent amendment now allows consumers to choose from different electricity suppliers. Different suppliers offer a different mix of energy sources. A detailed explanation of the framework is given in question 2.4 above.

FiTs Guarantees prices for electricity generated from renewable sources, paid per unit of electricity produced. FiTs provide long-term revenue certainty for project developers, typically applied to solar PV systems and other renewable technologies.

Power Purchase Agreements (PPAs) are long-term contracts between renewable energy producers and off-takers (e.g., the Israel Electric Corporation). PPAs stipulate the price and terms for selling electricity and providing financial stability for developers. In some cases, PPAs are awarded through competitive tenders or auctions, where developers bid for contracts based on price and other criteria.

Subsidies and grants direct financial support for the development and deployment of renewable energy projects. This can include grants for project development, research, and technological innovation.

About Jerusalem energy storage regulations

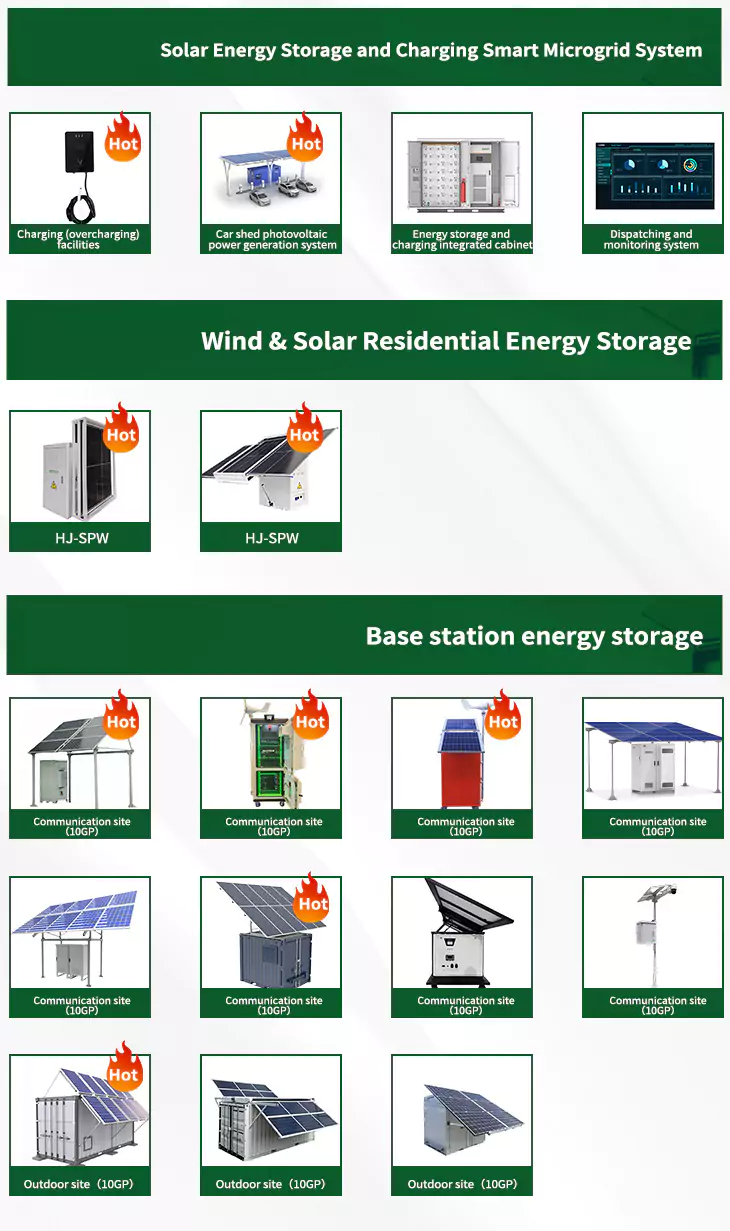

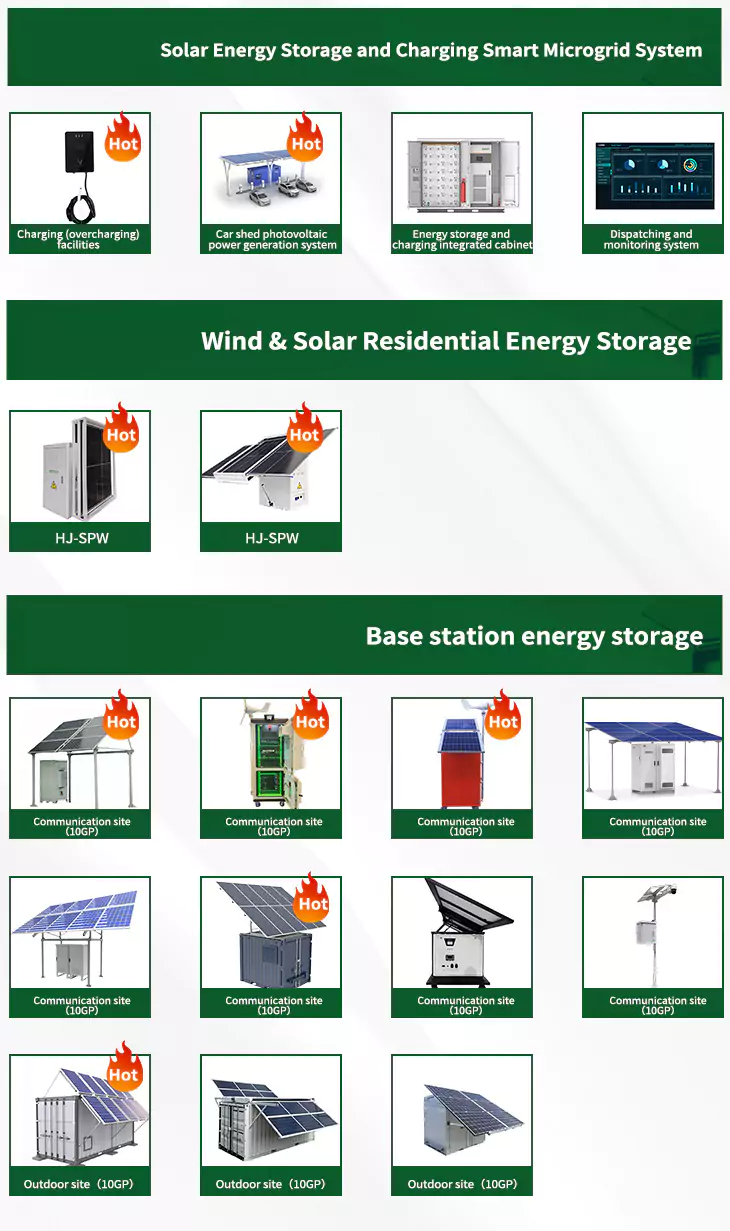

As the photovoltaic (PV) industry continues to evolve, advancements in Jerusalem energy storage regulations have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Jerusalem energy storage regulations for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Jerusalem energy storage regulations featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents