As subject matter experts, we provide only objective information. We design every article to provide you with deeply-researched, factual, useful information so that you can make informed home electrification and financial decisions. We have:

We won''t charge you anything to get quotes through our marketplace. Instead, installers and other service providers pay us a small fee to participate after we vet them for reliability and suitability. To learn more, read about how we make money, our Dispute Resolution Service, and our Editorial Guidelines.

Similar to solar energy, if you''re considering investing in energy storage, there are incentives and rebates available that can help lower your costs. From federal incentives to state rebates to utility programs to solar-adjacent incentives, here are a few ways that storage incentives can help fray the costs of installing a battery.

As a reminder, at EnergySage, we''re solar and storage experts, not tax experts. Tax codes are complicated, so please consult your tax advisor for a final determination of whether you''ll be eligible to receive tax incentives for solar and storage.

The best incentive for storage is the federal investment tax credit (ITC). The exact same ITC that provides a 30 percent credit on the cost of your solar system provides that same benefit to storage systems under certain conditions.

Due to the Inflation Reduction Act, as of 2023, all residential storage systems over 3 kilowatt-hours (kWh) in size are eligible for the ITC. Prior to 2023, batteries needed to be paired with solar and had to be powered by solar at least 75 percent of the time for five years in order to qualify for the ITC. For a typical home energy storage system, the ITC can reduce the cost of your system by $3,000 to $5,000.

For commercial properties, storage projects must be larger than 5 kWh in size and meet certain prevailing wage and apprenticeship requirements (the same as commercial solar projects) to receive the full 30 percent ITC. The ITC for commercial storage is only guaranteed until 2025.

Increasingly, a number of states now also offer energy storage rebates to encourage the growth of the storage industry. These incentives typically take one of two forms: an upfront rebate or a performance-based incentive. Rebate programs are exactly what they sound like: states provide a direct cash payment after your battery is installed and connected to the grid. To date, state-level performance incentives for storage have typically been added to solar incentives.

Perhaps the best-known state-level storage incentive in the US is California''s Self-Generation Incentive Program (SGIP). SGIP provides a dollar per kilowatt ($/kW) rebate for the energy storage installed. While the rebate level steps down as more homes and businesses add storage in California, in 2020, the state updated SGIP to provide more funding and higher levels of incentives for customers in high fire threat districts and for low-income customers to help provide emergency backup power to those that need it most.

Maryland is one of the only, if not the only, states in the country currently offering a storage-specific tax credit for its residents. The tax credit covers 30% of the cost of your storage system, up to $5,000 for residential batteries and up to $150,000 for commercial batteries. But act fast–this incentive is currently only authorized through the 2022 tax year and there''s a cap on the level of funding available each year.

Massachusetts offers a storage adder under the commonwealth''s solar-focused SMART incentive program. If you''re installing storage with a solar panel system, the per-kilowatt-hour incentive you''re paid for solar production will actually increase as a result of purchasing storage as well. (Yes, it''s interesting that the storage incentive pays you based on solar production, but we''re not complaining.)

While the state of New York has significant policy targets for energy storage (3 gigawatts by 2030!!), and while there are plenty of incentives for commercial-scale storage, the only incentive currently available for homeowners in the state at present is for residents of Long Island. This program offers a similar rebate-style incentive to California''s SGIP program, with the state currently offering a $250 per kilowatt rebate to Long Island residents. But this incentive won''t last forever–as of early 2021, 70% of the funds were already committed.

As an example of how solar battery incentives can influence the cost you pay, let''s take a Tesla Powerwall installation in California. You can read our article about the SGIP battery incentive for more in-depth information, but here''s how the costs play out once everything is all said and done:

Especially in a state like California, rebates and incentives can save you significant money on a solar plus storage installation! As solar batteries only become more popular, it''s likely that incentives like SGIP will continue to receive funding, and also will likely pop up in other states.

Beyond states taking steps to encourage greater adoption of energy storage technologies, some utilities are now also offering incentives to home and business owners who install storage. To date, most of these utility-specific storage incentives are in the Northeast, between the ConnectedSolutions program and Green Mountain Power''s storage programs.

While Vermont doesn''t have any state-specific storage incentives, their primary utility–Green Mountain Power–has been a pioneer for residential energy storage in the US. In fact, Green Mountain Power offers a few different programs for energy storage: a bring-your-own-device program that provides a rebate for whatever battery you want to install, as well as a Tesla Powerwall Pilot program.

You can look up your electric utility by your address here. Funds are limited for both incentive programs and will be administered on a first come, first served basis. The Department of Commerce will have approximately $2,160,000 available for incentives and is additionally collaborating with the Tribal Advisory Council on Energy to develop a program specific for Tribal Nations.

As of November 12, 2024, customers inside Xcel Energy''s service territory may access incentives for solar plus storage systems. Xcel Energy has approximately $3.48 million available for incentives. The following information has been provided by Xcel Energy:

About Battery storage incentives by state

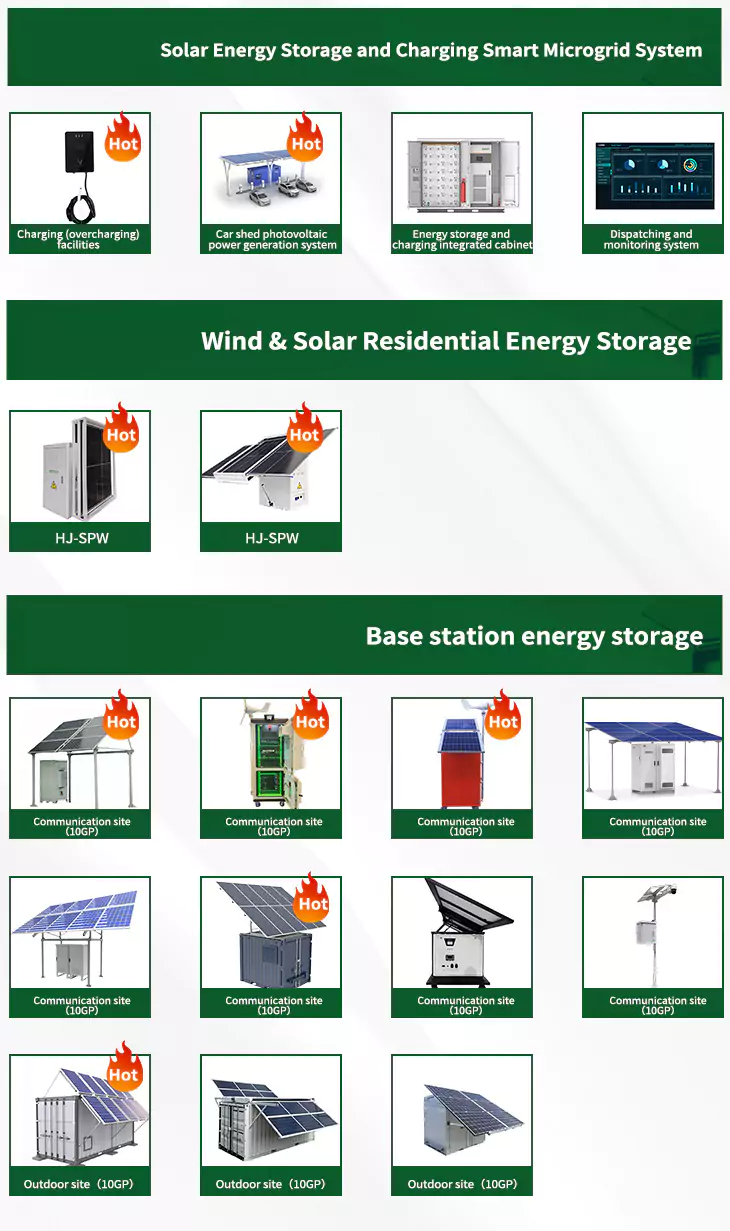

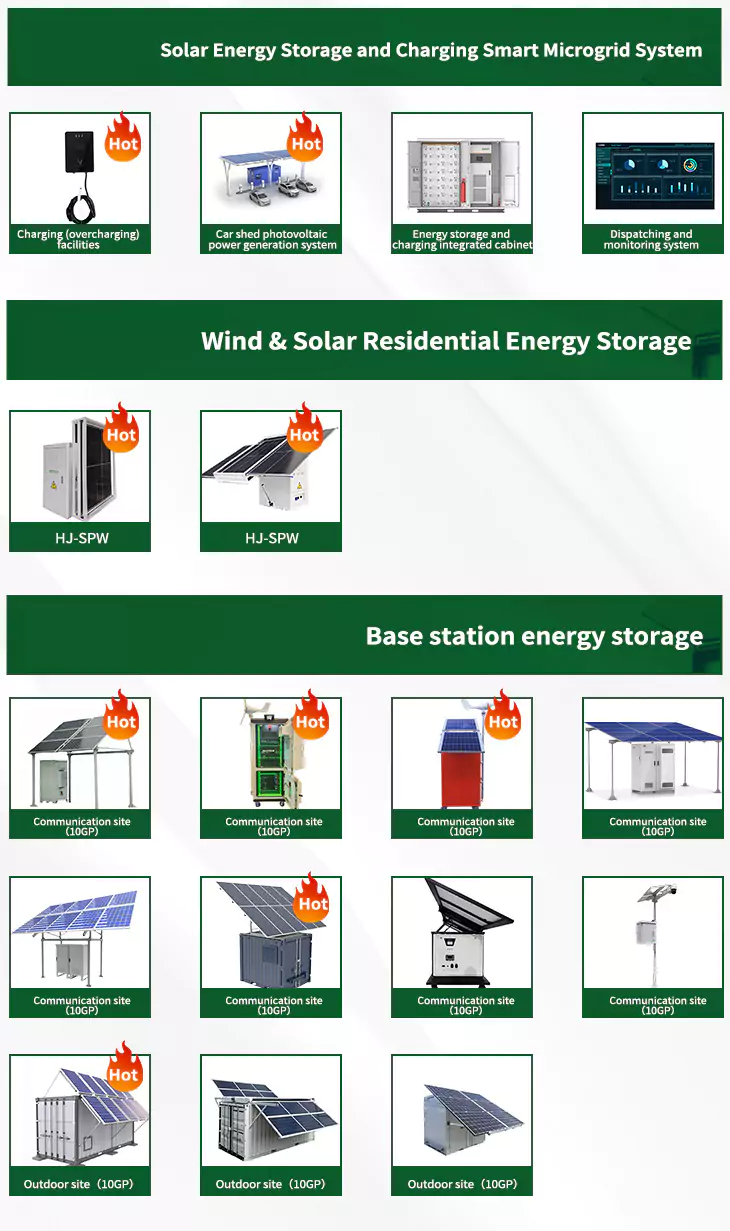

As the photovoltaic (PV) industry continues to evolve, advancements in Battery storage incentives by state have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Battery storage incentives by state for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Battery storage incentives by state featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents